Navigating the New BOI Reporting Requirements: A Guide for Businesses

Need help understanding your BOI reporting requirements? This guide from experienced business attorneys breaks down who needs to file and how.

Schedule a confidential consultation! CONTACT US

“Communication was amazing with fast responses to all emails and questions.

SEE OUR CUSTOMER REVIEWSSchedule a confidential consultation! CONTACT US

Schedule a confidential consultation! CONTACT US

“Communication was amazing with fast responses to all emails and questions.

SEE OUR CUSTOMER REVIEWSSchedule a confidential consultation! CONTACT US

Need help understanding your BOI reporting requirements? This guide from experienced business attorneys breaks down who needs to file and how.

The FTC released revised guidance for sponsorship disclosures. Our lawyers break down the most important things you need to know.

NIL or name, image, and likeness have been a game changer for NCAA student-athletes. Recent changes to NCAA policies now allow college athletes to profit from their brand through endorsement deals.

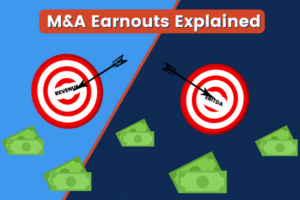

When making an offer to buy a company, buyers often include an earnout as part of the deal. An earnout is a payment that the seller will receive if the acquired business achieves certain performance milestones after closing.

Understanding common M&A Jargon can be a hassle, but we’ve got you covered! Here are some terms you may see in your next M&A deal!

The M&A process creates a lot of uncertainty and stress for everyone involved. You must make sure you cover every angle and protect your company’s interests as best as possible.

Before any M&A deal, it’s important to be aware of the tax considerations involved with your deal and how they may affect your business!

Reality TV star Kim Kardashian agreed to pay the SEC $1.26 million for failing to adhere to SEC guidelines. Here’s what you should know!

The SEC strikes again! Binance, the world’s largest crypto exchange, has found itself in hot water after the SEC launched

The Securities and Exchange Commission (SEC) is nearly doubling the number of dedicated positions responsible for protecting cryptocurrency investors. The

SEC to Crypto Industry: No Amnesty for Violations The U.S. Securities Exchange Commission (SEC) recently made it clear that cryptocurrency

It doesn’t take an avid investor to understand securities. From stocks and bonds to hedge funds, these are all terms

In 2021, the SEC Enforcement Division handed out $3.9 billion in penalties to companies and individuals found guilty of SEC

Fill out this form to schedule a confidential consultation with one of our highly-skilled, aggressive attorneys to help you tackle any tax or legal problem.

Or, you can call us at

Fill out this form to schedule a confidential consultation with one of our highly-skilled, aggressive attorneys to help you tackle any tax or legal problem.

Or, you can call us at

Submit your information to schedule a confidential consultation, or call us at (847) 580-1279