New IRS Initiative Targets High-Income Non-Filers

The IRS is targeting wealthy non-filers who haven’t filed tax returns between 2017 and 2021. Learn what you should do if you receive Notice CP59.

Schedule a confidential consultation! CONTACT US

“Communication was amazing with fast responses to all emails and questions.

SEE OUR CUSTOMER REVIEWSSchedule a confidential consultation! CONTACT US

Schedule a confidential consultation! CONTACT US

“Communication was amazing with fast responses to all emails and questions.

SEE OUR CUSTOMER REVIEWSSchedule a confidential consultation! CONTACT US

The IRS is targeting wealthy non-filers who haven’t filed tax returns between 2017 and 2021. Learn what you should do if you receive Notice CP59.

Navigating a tax audit can seem intimidating, but it doesn’t have to be a stressful ordeal. With the right knowledge and preparation, anyone can handle this process smoothly.

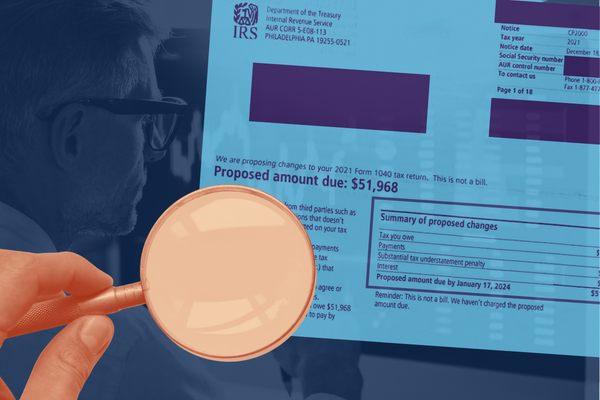

Are you a Robinhood or BlockFi user who’s received IRS letter CP2000? This is the start of a crypto tax audit. Here’s what you need to know.

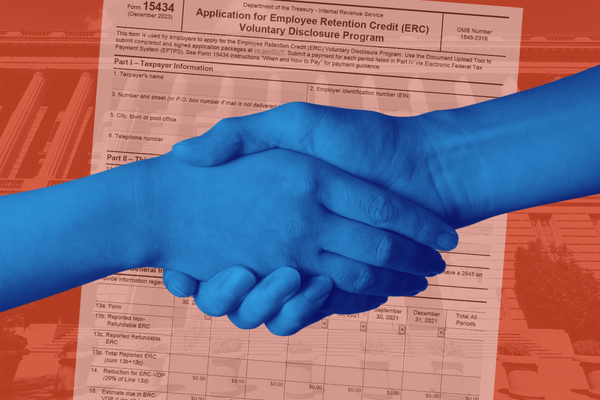

Get tax relief while you can! For a very limited time, the IRS is offering employers relief for repayment of the Employee Retention Credit (ERC). The new Voluntary Disclosure Program offers a significant discount on the tax owed, plus a waiver of interest and penalties.

The IRS has begun a new wave of audits targeting high-earning individuals and partnerships. Here’s how you can prepare.

The Inflation Reduction Act gives the IRS an additional $80 billion per year to increase services and collections.

Tax penalties can lead to many sleepless nights for taxpayers who owe the Internal Revenue Service (IRS). Delinquent taxes are

These are some of the top IRS audit triggers that could cause a closer look at your return. See our IRS Audit Survival Guide for more info.

Normally, the IRS can go back 3 years to audit you, but they can sometimes go back 6 years or indefinitely. Learn why from our tax lawyers.

The Qualified Small Business Stock (QSBS) tax exemption is a very powerful tax saving tool for those who qualify—it can

If you received an IRS crypto warning letter, you should call us sooner rather than later.

Not to be those people…but we told you so. Cryptocurrency Tax Letter 6174-A: IRS on the Hunt for Virtual Currency

If a person is audited by the IRS and agrees with the audit findings, he/she may sign an agreement form

Fill out this form to schedule a confidential consultation with one of our highly-skilled, aggressive attorneys to help you tackle any tax or legal problem.

Or, you can call us at

Fill out this form to schedule a confidential consultation with one of our highly-skilled, aggressive attorneys to help you tackle any tax or legal problem.

Or, you can call us at

Submit your information to schedule a confidential consultation, or call us at (847) 580-1279