While many Americans race to submit their income tax returns on time each year, they forget about another important tax form: the FBAR (otherwise known as Foreign Bank Account Reporting or FinCEN Form 114). For those who qualify, failing to submit this form can lead to a mountain of IRS penalties.

We’ve helped countless clients resolve this issue, and we can do the same for you! We’ll help you understand who needs to file the FBAR, how to file it, and what could happen if you don’t.

What Is the FBAR?

- The FBAR (FinCEN Form 114) is an information return that discloses information about certain offshore accounts with a combined value of $10,000 or more.

- It must be submitted to FinCEN each year you meet the filing threshold.

- Otherwise known as Foreign Bank Account Reporting, the FBAR reports the value of certain foreign assets you own, such as bank accounts or brokerage accounts hosted in countries outside the US.

Who Needs to File the FBAR?

An FBAR filing is required if:

- The filer is a U.S. person (this may include an entity, such as a registered business).

- The filer has certain types of accounts—including bank accounts, retirement accounts, and more—maintained in a foreign country.

- The filer has a financial interest or signature of authority over these accounts.

- The combined value of these accounts exceeds $10,000 during the tax year.

Let’s break down each of these requirements.

FBAR Filing Requirement #1: U.S. Person

Who is considered a “U.S. person,” anyway? A U.S. person can be any of the following:

- A U.S. citizen

- A resident of the United States

- Anyone granted a green card to reside in the U.S. permanently

- Anyone who lived in the U.S. for at least 183 days out of the year

- Anyone who files a first-year election on their income tax return

- An entity formed under the United States or any of its territories

If any of these apply to you, the government considers you a U.S. person.

FBAR Filing Requirement #2: Foreign Accounts and Assets

The types of foreign accounts and assets reported on FinCEN Form 114 include, but are not limited to:

- Bank accounts (checking or savings)

- Brokerage accounts

- Retirement accounts

- Life insurance policies that earn interest

- Trusts

FBAR Filing Requirement #3: Value of Accounts

The FBAR reporting threshold is $10,000; this is the combined value of all qualifying foreign accounts.

If your qualifying foreign assets had a combined value of $10,000 or more at any time during the tax year, you must file FinCEN 114. Even if the combined value was $10,001 for a single day out of the year, you’re still required to file.

FBAR Filing Requirement #4: Financial Interest or Signature Authority

It’s important to understand your relationship with the relevant foreign accounts; the filer may have a financial interest or signature authority over the account.

The term signature authority is fairly straightforward. It refers to anyone who can control the disposition of assets and funds through direct communication with the institution maintaining the account. This can be done individually or in conjunction with someone else.

Accounts held by an entity (such as an LLC, corporation, or trust) can create a financial interest for a U.S. person if the entity falls into any of the following:

- A corporation where a U.S. person owns more than 50% of the company’s stock

- A partnership where a U.S. person receives more than 50% in profits or capital gains

- A trust where the U.S. person is the owner

- A trust in which a U.S. person benefits from 50% of the assets or receives more than 50% of the current income

- An entity in which a U.S. person holds more than 50% of the voting power

Common FBAR Filing Scenarios

Filing Requirements: Married Filing Jointly

If you and your spouse only have foreign accounts that are jointly owned, you can file the FBAR form jointly.

Example: You and your husband have a jointly held savings account at a bank in Germany. Neither of you owns any other foreign accounts. You can submit a joint FBAR form for the tax year.

Filing Requirements: Married Filing Separately

The FBAR can be filed separately if:

- Only one spouse owns qualifying foreign financial accounts, brokerage accounts, or retirement accounts

- The other spouse has no authority over those accounts

If both spouses own qualifying accounts and the accounts are not jointly owned, you will each need to file a separate FBAR.

Example: You and your husband have joint checking and savings accounts in Canada. You also have an individual retirement account managed in Canada. You and your husband will need to file separate FBAR forms.

You and your husband will both report information on the checking and savings accounts; only you will report information on the retirement account.

Filing Requirements for Minors

The guardians of minors or those who can’t file themselves will need to file an FBAR on behalf of their charges.

It’s important to remember that even if the child is not required to file a tax return or the parents are filing a tax return on the child’s behalf, children with foreign accounts are still required to file.

These are some of the most common accounts for minors that must be reported:

- Foreign life insurance

- Bank accounts abroad (i.e., savings accounts and trust funds)

Example: When your child is born, you open a savings account in their name back home in France. By the time the child is 3, the savings account holds $10,000. You will need to file an FBAR on behalf of your child, using your child’s name and Social Security Number.

Filing Requirements for Businesses

U.S. companies (any corporation, partnership, trust, or LLC formed under the laws of the United States) are also subject to FBAR reporting if they own foreign accounts.

Example: You own a travel agency selling tours to New Zealand. The company has New Zealand bank accounts to pay vendors, and the combined value of the accounts is over $10,000. Your company will need to file an FBAR.

When is the FBAR Filing Deadline?

The deadline for FBAR filing is April 15 (June 15 if you’re a U.S. person living abroad). However, if you don’t file in time, you get an automatic extension to October 15.

If you missed the October 15 deadline, reach out to an an experienced FBAR lawyer to discuss your options. Multiple programs exist to provide a level of amnesty for delinquent FBARs.

What Happens If You Miss the FBAR Deadline?

Failing to file the FBAR on time can lead to steep FBAR penalties. This is true even if you weren’t aware of the filing requirement. Penalties are more severe for intentional violations, and can even include jail.

Luckily, there are many options to correct unfiled FBARs. These include:

- Amended FBARs or “quiet disclosure”

- Delinquent FBAR Submission Procedures

- Streamlined Foreign Offshore Procedures (available to U.S. expats)

- Streamlined Domestic Offshore Procedures (available to those living in the United States)

- IRS Voluntary Disclosure Program

Navigating these FBAR amnesty options is complex, and a misstep could lead to expensive penalties or worse. Call our experienced FBAR lawyers at (847) 580-1279 to help guide you through!

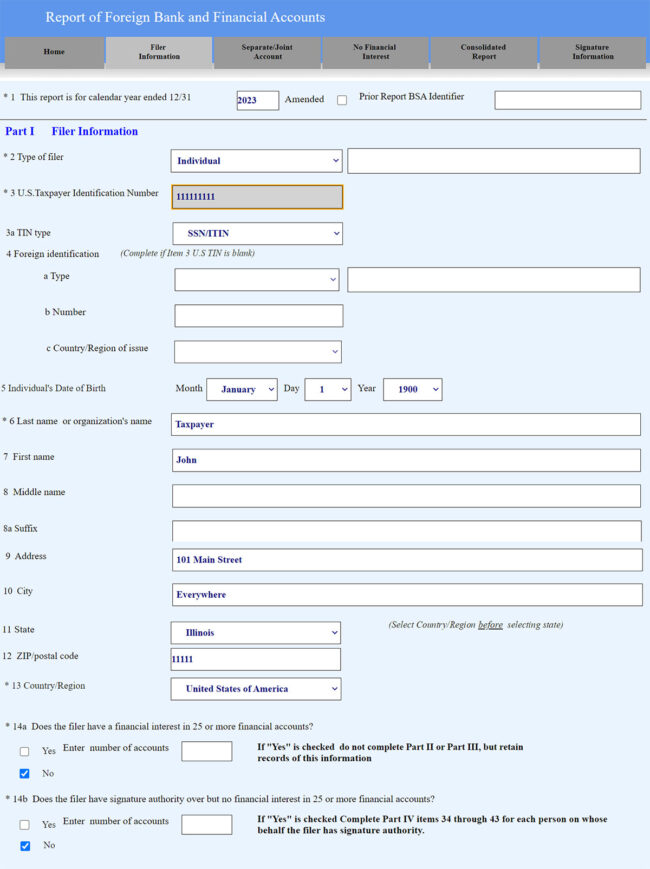

How to File FinCEN Form 114

The FBAR filing process can be a lot to deal with if it’s your first time having to submit. We recommend consulting with one of our experienced FBAR lawyers for a timely and accurate filing.

Individuals can complete FinCEN Form 114 online or upload a PDF through the BSA E-Filing System. Before you get started, it’s best to have all the necessary documentation prepared and up to date.

To file the FBAR (or have a tax professional file the FBAR for you), you’ll need the following information:

- Your name, Social Security Number or ITIN, and address.

- The name, Social Security Number or ITIN, and address of all joint account owners.

- The names and addresses of all foreign financial institutions where you hold accounts.

- Types of accounts you own (checking, savings, securities, etc.) and account numbers.

- The maximum value of each account during the tax year (Jan. 1 – Dec. 31) in U.S. dollars. Use the U.S. Treasury’s foreign exchange rate as of Dec. 31 of the year you’re reporting.

Need Help Filing The FBAR?

Navigating the FBAR filing process can be complex and one slip up can lead to significant penalties! Avoid the hassle and let one of our FBAR lawyers help you accurately report your foreign income. Get started today with a free, confidential consultation.