The IRS recently unveiled the long-awaited draft Form 1099-DA, the first tax form created specifically for reporting digital assets. The release of this draft form follows the IRS’s announcement last year of proposed regulations on reporting requirements for brokers regarding the sale or exchange of digital assets.

Once Form 1099-DA is finalized, taxpayers will receive this form from brokers (such as cryptocurrency exchanges) detailing their digital asset transactions.

While the new form is intended to make crypto tax reporting much simpler, there are still many potential issues that taxpayers and brokers alike should keep in mind.

Gordon Law has focused on cryptocurrency taxation since 2014, helping more than 1,000 investors and businesses stay tax-compliant. Here’s what you need to know about this important new tax form.

What is Form 1099-DA and Why Was it Created?

Surveys indicate that a significant number of crypto investors in the US are not compliant in their tax reporting. With the growing popularity of digital assets, the US government is prioritizing more tax reporting guidance to enhance cryptocurrency users’ tax compliance. As a part of this effort, the Infrastructure Investment and Jobs Act (IIJA) that President Biden signed in 2021 requires crypto exchanges and platforms to report information regarding digital asset transactions to the IRS.

Form 1099-DA was created for brokers to report the required information about digital asset transactions to the IRS. It’s expected to go into effect with the 2025 tax year, meaning taxpayers will receive the form in 2026.

The introduction of this new form is a step in the direction of making crypto tax information more accessible and transparent.

Who Needs to Submit Form 1099-DA?

Anyone considered a digital asset broker is required to submit Form 1099-DA to the IRS and taxpayers. One of the more contentious points of the proposed regulations is defining what a broker is when it comes to who is required to report digital asset transactions.

The IRS’s proposed regulations go into extensive detail about who should be considered a broker. They emphasize entities that are “in a position to know” the identities of the parties involved in digital asset transactions.

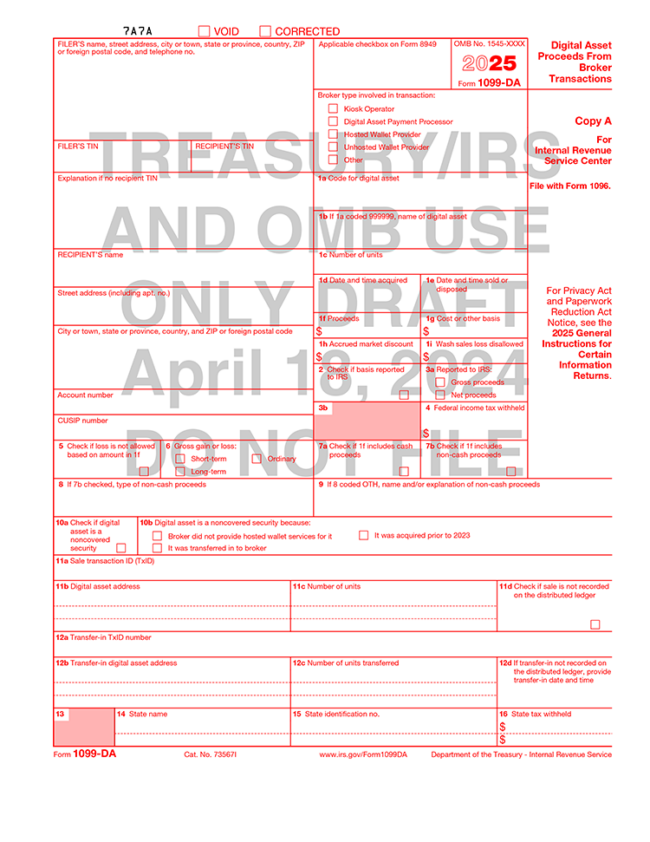

In its current draft, Form 1099-DA requires brokers to check a box indicating if they are one of the following 5 options:

- Kiosk operator (Bitcoin ATM)

- Digital asset payment processor (including both centralized and decentralized exchanges)

- Hosted wallet provider

- Unhosted wallet provider

- Other

One significant concern for those in the crypto space is the inclusion of unhosted wallets, also known as cold wallets or self-custodied wallets, as some believe this casts too wide a net for who should be considered a broker.

But there is a small glimmer of hope, which comes from Coinbase’s battle with the SEC.

On March 27, 2024, during Coinbase’s attempt to have its SEC lawsuit dismissed, the judge stated that “the factual allegations concerning [Coinbase] Wallet are insufficient to support the plausible inference that Coinbase ‘engaged in the business of effecting transactions in securities for the account of others’ through its Wallet application.” Based on this view, both hosted and unhosted wallets should not be subject to Form 1099-DA reporting.

The definition of a crypto broker has not yet been finalized, so some of the above options may be removed from the final version of the form.

Notably, the IRS’s proposed regulations do not consider any of the following to be brokers:

- Miners, node operators, or others who are simply maintaining the blockchain

- Software developers who indirectly facilitate digital asset transactions (for example, by developing code for a company like Coinbase)

- Smart contract developers who receive income from a smart contract they created, but do nothing to maintain or update it

Previously, due to the broad language of the Infrastructure Act, there was a great deal of concern that these parties would be considered brokers and would face reporting requirements that they couldn’t possibly fulfill.

What Does the Release of the Draft Form 1099-DA Mean?

One important thing to note about the draft Form 1099-DA is that this is not an announcement of new policy. The IRS created the draft form based on the language of the proposed regulations they issued in August 2023. The draft form does not consider any comments provided to the agency about the proposed regulations. There is still time for the IRS to make changes to the policy, so there may be some differences between the final version and this draft.

What Information is Reported on Form 1099-DA?

The draft Form 1099-DA gives us a sneak peek into the information the IRS is looking for brokers to provide to traders on the form.

Generally speaking, Form 1099-DA will report information about the sale or disposition of digital assets. The IRS specifies that this includes cryptocurrencies, NFTs, and stablecoins.

Form 1099-DA will report the same information that’s currently reported on Form 1099-B for stocks:

- When you got the digital asset (Acquisition date)

- How much you paid for it (Cost basis)

- When you sold or swapped it (Sale or disposition date)

- How much money you got from selling or swapping it (Sales proceeds)

We’ve highlighted some of the important information brokers are required to report.

Cost Basis

Taxpayers should be extremely wary of how cost basis is reported—or not reported—on Form 1099-DA. Box 1g of the draft form is for reporting cost basis. This will include both an itemized list for each transaction and the total sum.

However, the IRS explains that brokers may report a blank cost basis if the asset was transferred from another broker, if the asset was acquired before January 1, 2023, or if it was sold before January 1, 2026.

The instructions guide taxpayers to determine their own cost basis if they find the box blank on a form they receive.

Pro Tip: Due to the nature of cryptocurrency trading, we anticipate that a vast majority of transactions will have a missing cost basis. Taxpayers should not rely on Form 1099-DA to report an accurate cost basis. Instead, create your own report using crypto tax software or an experienced professional.

Proceeds

Similarly, box 1f reports proceeds, both itemized and total. It’s crucial to be aware that the amount of proceeds reported could make it seem like you owe more capital gains tax than you really do.

In addition to reporting the amount of proceeds, boxes 7a and 7b require the broker to distinguish between whether cash or non-cash proceeds were received. In other words, did you trade/swap the digital assets or cash out? This information will let the IRS know the type of trade reported on the form.

Pro Tip: Box 3a asks the broker to specify whether the reported proceeds are gross proceeds or net proceeds. Many taxpayers might assume that net proceeds are the same as capital gains, but that doesn’t seem to be the case based on the instructions for draft Form 1099-DA. Rather, net proceeds will report proceeds from options.

Code System for Digital Assets

Unsurprisingly, the form requires the disclosure of specific details about the digital assets. Box 1a of the form is labeled “code for digital asset,” indicating the IRS plans to codify digital assets for this form. The IRS has not yet released the code system, but it is safe to assume that not all digital assets will be included on the list.

Anticipating this fact, the IRS included box 1b to provide the name of any digital asset for which “999999” is used in box 1a. It appears “999999” serves as the code for assets not assigned a unique code for box 1a.

We anticipate that many transactions will use the “999999” code for “other” assets, since a majority of our clients’ transactions involve altcoins.

Date and Time Reporting

Boxes 1d and 1e are for reporting the date and time the asset was acquired and disposed of. Brokers will use Coordinated Universal Time (UTC) for these boxes, which aligns with standard practices already used in the crypto space.

The instructions also note that brokers may leave these boxes blank in certain circumstances. Those situations include when the digital asset sold, disposed of, or exchanged was acquired on various dates and times or the broker does not know when the asset was acquired–an extremely common situation when transferring digital assets between different wallets and accounts.

This point highlights another reason taxpayers must continue tracking their crypto transactions separately and not rely on Form 1099-DA alone to prepare their tax returns.

Wash Sale Rules

One shocking inclusion on the form that taxpayers should be aware of is a box for reporting “wash sale loss disallowed.” Currently, the wash sale rules do not apply to digital asset transactions. However, including this box on the form suggests the IRS may anticipate a potential change to this rule.

A wash sale is when one security is sold or traded for a loss, and then the same or substantially similar security is repurchased 30 days before or after the loss transaction.

Congress has previously tried and failed to apply the wash sale rule to crypto. This loophole currently provides a significant tax advantage, allowing cryptocurrency traders to harvest tax losses and buy their assets back in less than 30 days.

Other Information About the Transactions

Boxes 11a through 11d and 12a through 12d require the following information to be disclosed about crypto transactions:

- Transaction ID or hash

- Digital asset address

- Number of units of the digital asset disposed of from each address listed in the previous box

- A checkbox for whether the sale is recorded on the distributed ledger

Potential Problems with Form 1099-DA

Although Form 1099-DA is intended to make crypto tax reporting easier, the proposed regulations and draft form present several potential issues for both taxpayers and brokers. The new form is unlikely to solve all your crypto tax reporting headaches, and may create serious problems.

The solution? Continue to create your own crypto tax report using software or an experienced cryptocurrency accountant.

Previously Unreported Crypto

Once brokers start sending Form 1099-DA, the IRS will likely uncover anyone who has not historically reported their digital asset activity properly on their tax returns.

If you believe you fall into this category, contact one of our crypto tax attorneys as soon as possible to address this problem. You may be at risk of a cryptocurrency tax audit or even a criminal tax investigation.

Pro Tip: One potential option to avoid prison is the Voluntary Disclosure Program (VDP); cryptocurrency was added to the program in 2022. This step must be taken proactively. If the IRS initiates an audit or investigation against you, you will no longer be eligible for the VDP.

Transferring Crypto Between Digital Asset Brokers

To provide accurate cost basis information on Form 1099-DA, digital asset brokers (exchanges, wallets, etc.) will need to share information when assets are transferred between them.

This type of information sharing already occurs between stock brokers—for example, if you move stocks from Robinhood to eTrade. However, cryptocurrency transfers occur much more frequently (often several times within a single transaction), and digital asset brokers are not currently set up to share cost basis information with each other.

Brokers must report crypto proceeds on Form 1099-DA, but many taxpayers will find a great deal of cost basis information missing, leading to inflated capital gains. If you rely solely on information from Form 1099-DA, you may end up paying much more tax than you really owe.

Self-Transfers

Most of our crypto tax clients use several cryptocurrency exchanges and wallets. Transferring your crypto between these accounts isn’t taxable, but digital asset brokers often have no way to differentiate between self-transfers and taxable sales.

Therefore, it’s likely that Form 1099-DA will incorrectly classify self-transfers and show inflated proceeds. A mismatch between your actual proceeds and the amount reported on 1099-DA could be a potential audit trigger.

Accurately reporting all transactions on Form 8949 can help prevent problems.

Foreign Exchanges

Offshore exchanges that don’t serve US customers will not be required to issue Form 1099-DA.

If you use these exchanges, you won’t get all the information you need to report crypto on your taxes. And if you move crypto around between foreign exchanges and US brokers, it’s fairly simple for the IRS to discover those foreign accounts.

How to Prepare for Form 1099-DA

Digital Asset Brokers

Anyone who may be considered a digital asset broker (including exchanges, wallets, and Bitcoin ATMs) should seek advice from an experienced crypto tax attorney as soon as possible. We’ll help you determine whether you’re required to file Form 1099-DA and plan for how to comply.

Ensuring compliance is important, since noncompliance penalties can be as high as $3,532,500 per year.

Taxpayers

If you haven’t reported your crypto correctly in the past (either intentionally or by mistake), now’s the time to create an action plan. Intentionally omitting income sources on your tax return could lead to criminal charges, severe financial penalties, and even prison.

The IRS is typically much more lenient with taxpayers who are proactive with fixing mistakes. Call our experienced crypto tax attorneys today to discuss possible solutions, including amended tax returns and the Voluntary Disclosure Program.

Additionally, make sure you report correctly moving forward. You can use crypto tax software to calculate your capital gains, or Gordon Law can do all your reporting for you! We also offer Crypto Audit Defense plans for those who are concerned about their audit risk.

We’ve helped thousands of clients avoid trouble with the IRS. Don’t wait until you receive Form 1099-DA; schedule a confidential consultation with one of our attorneys today and find out how to prepare!