An IRS tax levy can put your property and personal assets at risk. Back taxes are hard to eliminate, and the IRS can start the collection process without going to court.

A tax levy is one of the IRS’s harshest methods to collect taxpayer debt.

Learn more about what a tax levy is, how it works, and how to avoid losing your property to pay off tax debt.

What Is an IRS Tax Levy?

A tax levy is the IRS collection process used to legally seize property or assets to satisfy a delinquent tax debt. The IRS will typically issue a tax levy after a tax lien has already been placed.

An IRS tax lien is a claim the government can make on your property and assets. If you receive a lien and your tax debt still goes unpaid, the IRS can move on to a levy. Once the tax levy is effective, the IRS actually begins to exercise its claims against the property and assets.

In other words, a tax lien can be thought of as a warning to repay your tax debt. With a levy, the IRS takes matters into its own hands and begins to collect, whether you cooperate or not.

How Does a Tax Levy Work?

Before the IRS can move in on your property and assets, they must provide you with fair notice.

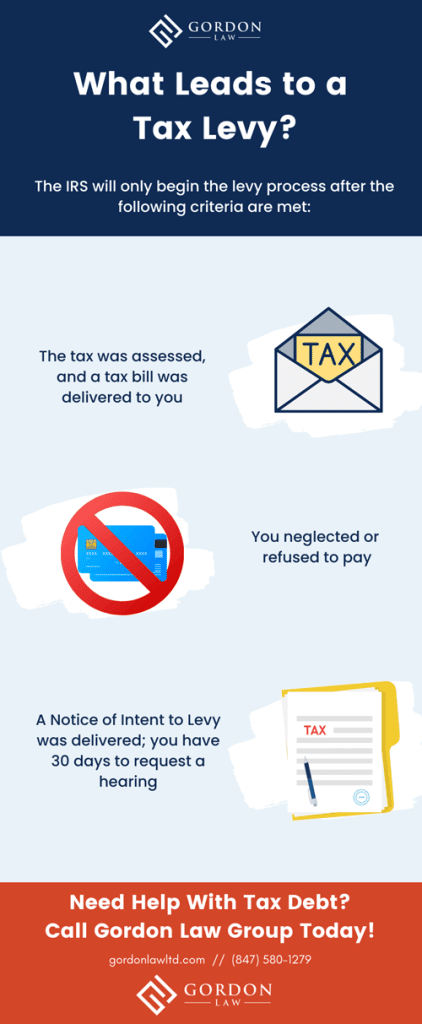

The IRS will only begin the levy process after the following criteria are met:

- The tax was assessed, and a tax bill was delivered to you

- You neglected or refused to pay

- A Notice of Intent to Levy was delivered; you have 30 days to request a hearing

- You were informed the IRS might contact third parties regarding the collection of tax (only applicable if the IRS assigns the levy to a 3rd party)

Once the 30-day period has expired, the IRS can move forward with the levy. Depending on the situation, the government can use different types of levies to recover the money owed.

Types of Tax Levies

The IRS has the authority to place a levy on a broad range of your assets. Some levies are used more often than others, but it varies case by case.

Here are some of the most common types of IRS tax levies.

Reduced Tax Refunds

The IRS can damper your day by intercepting any tax refunds you may be expecting. Federal and state tax refunds can be levied and sent directly to the IRS.

Wage Garnishment

Wage garnishment is a type of reoccurring levy. The IRS will take a portion of your paycheck until your back taxes (along with IRS tax penalties and interest) are paid.

The IRS will contact your employer in order to set up wage garnishment. Your employer is legally obligated to comply with the IRS notice to levy, but they can’t terminate you because of it. If an employer fails to process the garnishment within an allotted period, they can face penalties.

Your filing status and number of dependents determine how much the IRS deducts from each pay period. If you have multiple income streams, the IRS may garnish 100% of the wages from one of your jobs. Any bonuses received during this time can be levied for the total amount.

The IRS can continue to garnish your wages until your tax debt is fully repaid.

Accounts Receivable Levies

Even if you’re self-employed and don’t receive a traditional paycheck, the IRS can still come after your livelihood by levying your business’s accounts receivable.

If you’re expecting a large payment from a client, the IRS can contact that client and divert the payment to satisfy your tax debt. This can continue until the tax lien has been cleared.

Bank Levies

A bank levy allows the IRS to contact your bank and seize any funds available for withdrawal. Once your bank receives a levy notice, a 21-day hold will be placed on your account and you’ll be unable to withdraw funds during that time.

If the amount of back taxes owed is more than you currently have, the IRS may drain your entire bank account. Bank levies may continue until your debt has been satisfied. If your account has insufficient funds the first time around, the IRS can come back multiple times or seize assets from other accounts, including joint accounts.

Property Seizure

Property seizure is one of the most severe types of levies the IRS can place on taxpayers. This levy is usually reserved for severe situations where a taxpayer has committed tax fraud or tax evasion, or other levies don’t suffice.

The IRS can seize your home, vehicles, and any other property you may own to fulfill the debt.

Can an IRS Levy Be Released?

It’s always best to start repaying your tax debt before you get levied so that you have more options. In most cases, the IRS will only release a levy once the entire tax debt has been paid.

The IRS can also release a levy for the following reasons:

- Releasing the levy will help you repay your debt

- An installment agreement is arranged, and the terms don’t allow the levy to continue

- The value of the property is more than the amount owed

- The levy results in immediate economic hardship for the taxpayer

It’s important to note that the release of a levy doesn’t always mean the tax debt you owe is null and void. The IRS will reissue the levy unless you make arrangements to repay your tax debt.

Let Us Help with Tax Debt Relief

IRS tax debt can be scary, and once a levy has been placed, things can get even more difficult. If you believe you may be on the verge of receiving a levy notice or if you’ve already gotten one, you shouldn’t waste any time.

Let our experienced tax lawyers help you relieve your tax issues today!