If you have IRS back taxes that go unpaid for an extended period, you may be subject to IRS tax liens.

Ignoring your IRS debt won’t make it go away; it only makes it harder to repay and get back into good standing with the IRS. We know that any amount of tax debt can feel overwhelming—that’s why our experienced tax attorneys are here to help!

Let’s look at what tax liens are, how long they can affect you, and ways to remove them.

What is an IRS tax lien?

An IRS tax lien is a legal claim against the assets of an individual or business in debt to the government. Tax liens are commonly issued against a taxpayer’s home or vehicle. The IRS has an ownership claim on the specified property until your tax bill is paid.

Failure to repay your debt and IRS tax penalties can result in the seizure of personal property and financial assets, including property acquired after the lien was issued. Tax liens are often reserved for tax debt of at least $10,000.

Having your prized possessions in limbo is just one of the consequences of IRS tax liens. Applying for credit or financing with other institutions becomes challenging once the government has filed a lien against you; a tax lien won’t lower your credit score, but it is public information that anyone can view.

When does the IRS file a tax lien?

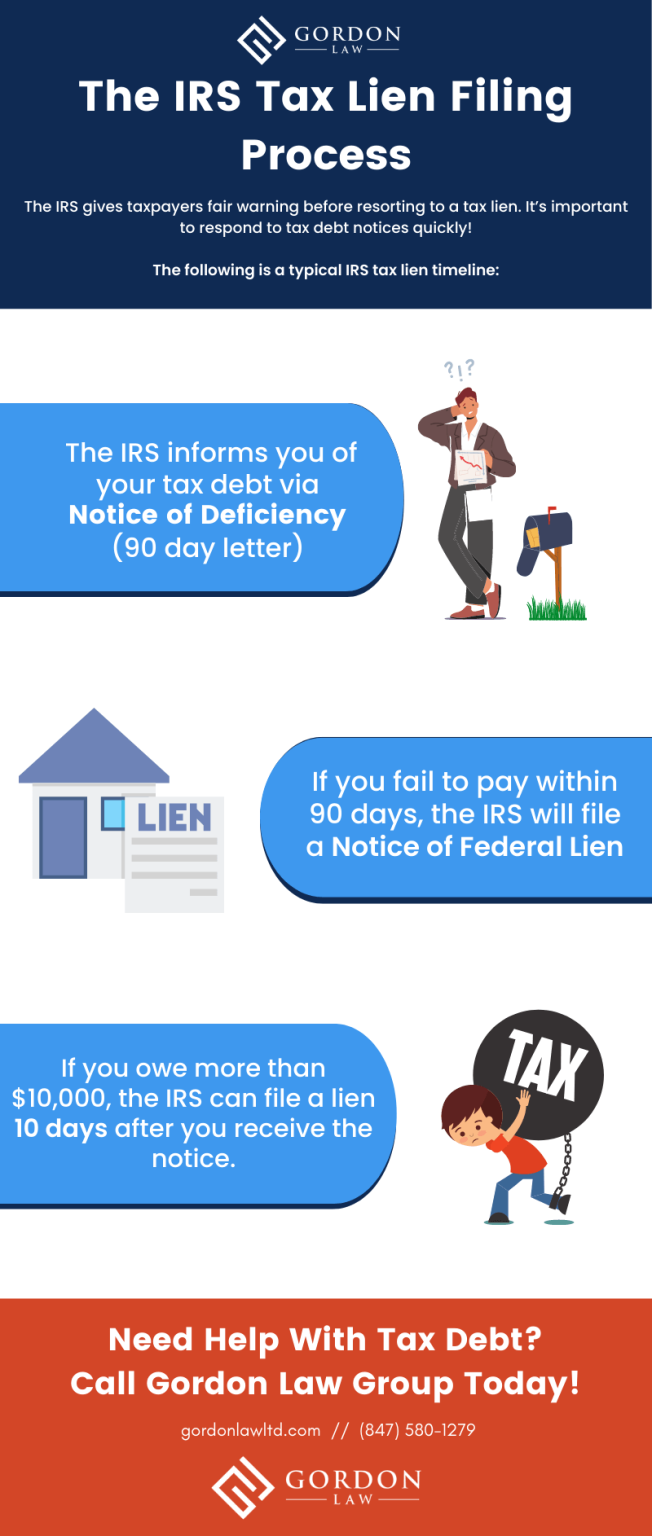

The IRS gives taxpayers fair warning before resorting to a tax lien. Once a lien is in place, it is difficult to remove, so it’s important to respond to tax debt notices quickly and avoid the worst-case scenario.

The following is a typical IRS tax lien timeline:

- The IRS will inform you that you owe via a Notice of Deficiency (also called a 90-day letter), which gives you 90 days to pay

- The IRS will automatically create a Notice of Federal Tax Lien if you neglect or refuse to pay by the deadline

- If your debt is $10,000 or more, the IRS will file a tax lien as early as 10 days after you receive the lien notice

The Notice of Federal Tax Lien becomes public record to notify other creditors that the IRS has first dibs on your assets and property if you cannot repay.

If your total debt is less than $10,000, the IRS may still issue a tax lien if the need to collect is urgent. The IRS may act swiftly in these situations if they doubt you will be able to pay what you owe due to bankruptcy or if they’ve found out you are already liquidating your assets.

How long does an IRS tax lien last?

IRS tax liens expires with your tax debt; the IRS can only continue collection efforts within the statute of limitations. The clock for tax debt begins on the date of your initial tax bill from the IRS, and the statute of limitations is typically 10 years.

However, there are several reasons the collection statute expiration date (CSED) may be extended:

- Bankruptcy

- Living abroad for 6 months

- Military deferment

- Collection Due Process (CDP) hearing

- Filing a petition to US Tax Court

- Obtaining Innocent Spouse Relief

- A taxpayer assistance order

- Filing for an Offer in Compromise (the clock is paused while the application is being processed)

You may be able to avoid the Tax Man momentarily, but the debt will catch up to you in the long run. After filing a tax lien, if your debt remains unpaid, the IRS can up the ante and move forward with a tax levy.

It’s always best to get ahead of your tax obligations and cooperate with the IRS. Our experienced team can take over the entire process for you! Consult with a tax lawyer to help you save time and money.

How do you remove an IRS tax lien?

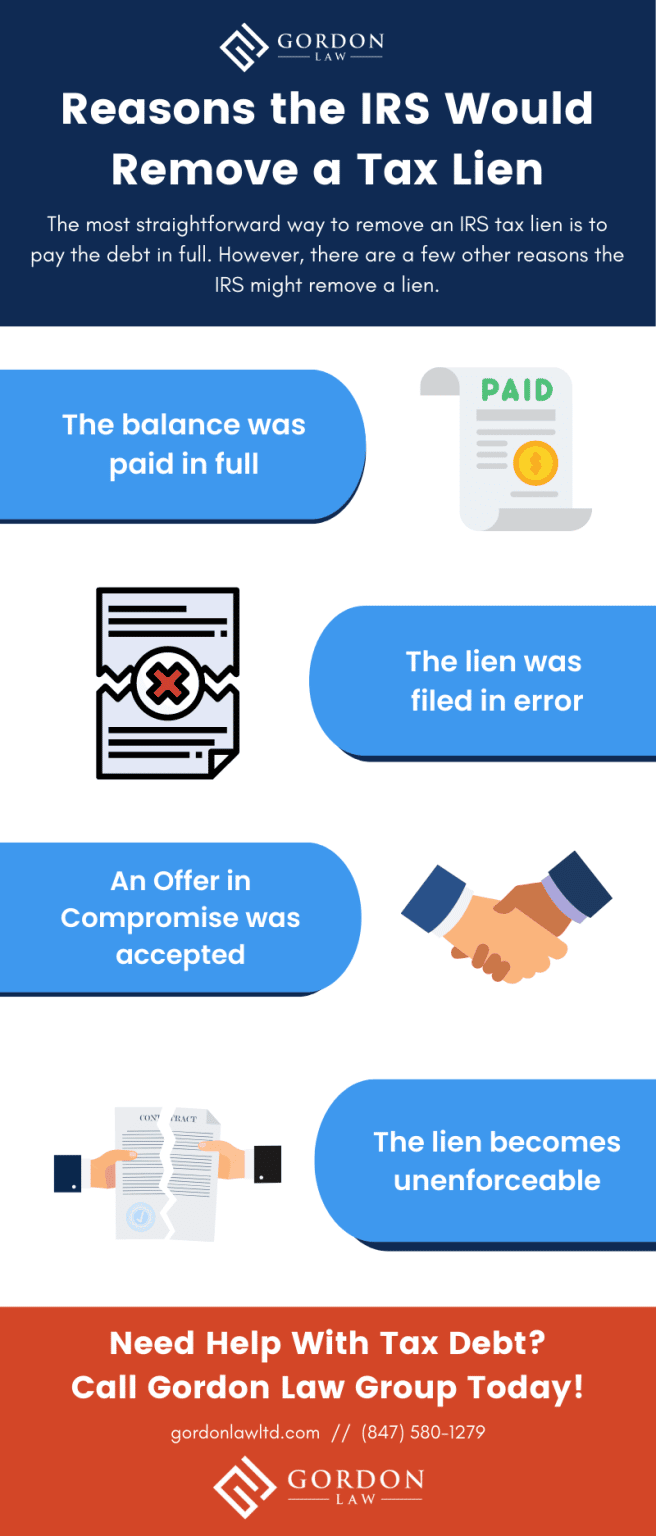

The most straightforward way to remove an IRS tax lien is to pay it. Period. However, the IRS will also release a tax lien if it was filed in error or if the outstanding balance was satisfied through a successful Offer in Compromise.

Besides payment in full, the 2 most common ways to remove IRS tax liens are withdrawal and release. Lien subordination is another option that won’t remove the lien, but can provide temporary relief.

Withdrawing an IRS tax Lien

The IRS will withdraw a tax lien if there is an error, such as targeting the wrong taxpayer for debt. If you find yourself in this situation, the lien can be erased from your record as if it were never filed.

You should immediately contact the IRS to allow them to review your account and verify that an error was made.

Releasing an IRS tax lien

The IRS will automatically release tax liens within 30 days of receiving full payment of the debt owed. The lien is removed from the public record within 30 days of the release. A specific type of installment agreement can also remove the lien if certain requirements are met.

The IRS also may remove a lien if they believe it can speed up the collection process or if it’s in the best interest of both parties—for example, if the taxpayer is undergoing bankruptcy.

Lien subordination

Having an IRS tax lien can make it hard to seek a loan or refinancing.

In some cases, the IRS may grant you a Certificate of Subordination, allowing other creditors to jump ahead of the IRS in priority. This offers an opportunity to refinance your home or other property, which can free up money to help repay tax debt.

However, this does not remove the IRS tax lien or your obligation to pay.

Find help from an experienced tax attorney

Dealing with years of back taxes and debt can be stressful, but it’s a problem that can be solved. The IRS offers eligible taxpayers a number of solutions to reduce tax debt and get back in good standing.

Our team of experienced attorneys has helped hundreds of clients resolve issues with the IRS, and we can do the same for you!