Tax Audit Lawyer in Chicago | Attorney for IRS Audit, Illinois Audit, and Chicago Tax Audit

Save time, save money, and get the IRS off your back!

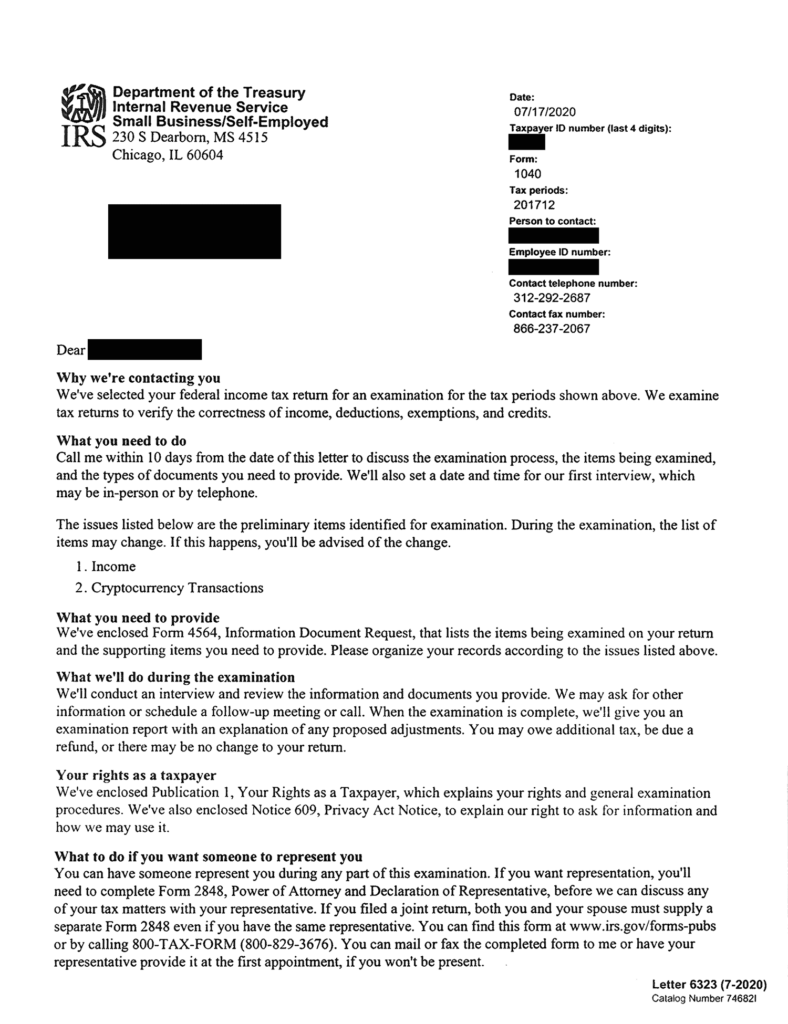

Are you facing an IRS tax audit? Don’t face it alone! Our skilled tax audit lawyers are here to help you fight the IRS and avoid high tax bills. With years of experience and a track record of success, we’ll make your audit as stress-free as possible! Contact us online or call (847) 580-1279 for a free consultation.