For married couples filing joint tax returns, “through thick and thin” can refer to more than just wedding vows. You’re living happily ever after until one day your spouse is arrested for tax evasion. Innocent spouse relief is a way to absolve your responsibility for the debt by proving to the IRS that you had no knowledge of wrongdoing.

If you’ve found yourself in this battle, we’ll explain everything you need to know to determine whether you qualify for innocent spouse relief and how to apply!

What is Innocent Spouse Relief?

Innocent spouse relief is one of the 3 types of tax relief the IRS offers to a spouse attempting to avoid tax penalties for a substantial understatement on a joint return.

When married couples file a joint tax return, both individuals are deemed responsible for all taxes owed. This is known as joint and several liability.

But what if one spouse created a tax nightmare by trying to hide money from the IRS? This doesn’t only create tax debt—it can even have criminal consequences.

The IRS implemented innocent spouse relief to allow the other spouse a chance to escape liability for joint tax returns. Requesting innocent spouse relief is only one part of the battle. The requirements are strict, and acceptance is solely based on the evidence provided.

Who Qualifies for Innocent Spouse Relief?

Innocent spouse relief can be a saving grace for those who qualify. But if the IRS feels you don’t meet the specific criteria for this tax relief program, then you’re back at square one.

To qualify for innocent spouse relief, the following must be true:

- You filed a joint return that contained an understatement of tax due to an erroneous item of your spouse or former spouse

- The innocent spouse did not know and had no reason to know of the substantial understatement at the time you signed

- It would be inequitable to hold the innocent spouse liable for the tax

- You and your spouse did not transfer any property to one another as a part of a fraudulent scheme

The qualifications for innocent spouse relief are strict. To ensure you’re putting your best foot forward, we recommend consulting with an experienced tax debt attorney before submitting your request.

Actual Knowledge and Reason to Know Test

Actual knowledge and the reason to know test are crucial in determining whether you qualify for innocent spouse relief. If you were aware of the tax deficiency at the time of the return, you would be liable for any penalties and interest due.

Since it’s difficult to prove a spouse had actual knowledge of any wrongdoing, the IRS made it easier for themselves by only needing to prove that you had a reason to know of the understatement.

The reason to know test is one of the IRS’s primary qualifications to determine whether you qualify for innocent spouse relief. If the IRS can provide evidence that you should have known of the issue, you will not be eligible for innocent spouse relief.

Some of the things the IRS will consider in the reason to know test include:

- The nature of the erroneous item (for example, an unreported income source) and the amount of the erroneous item relative to other items

- Whether you and your spouse’s financial situation drastically changed

- Your educational background and business experience

- The extent of your participation in the activity that resulted in the erroneous item

Example: Jim and Jan went from a blue-collar middle-class family to living a life of luxury.

Jan was confused about where all the expensive gifts were coming from, but she didn’t ask questions and enjoyed her new penthouse lifestyle.

In this case, Jan would not qualify for innocent spouse relief due to the fact she probably should have known something wasn’t right.

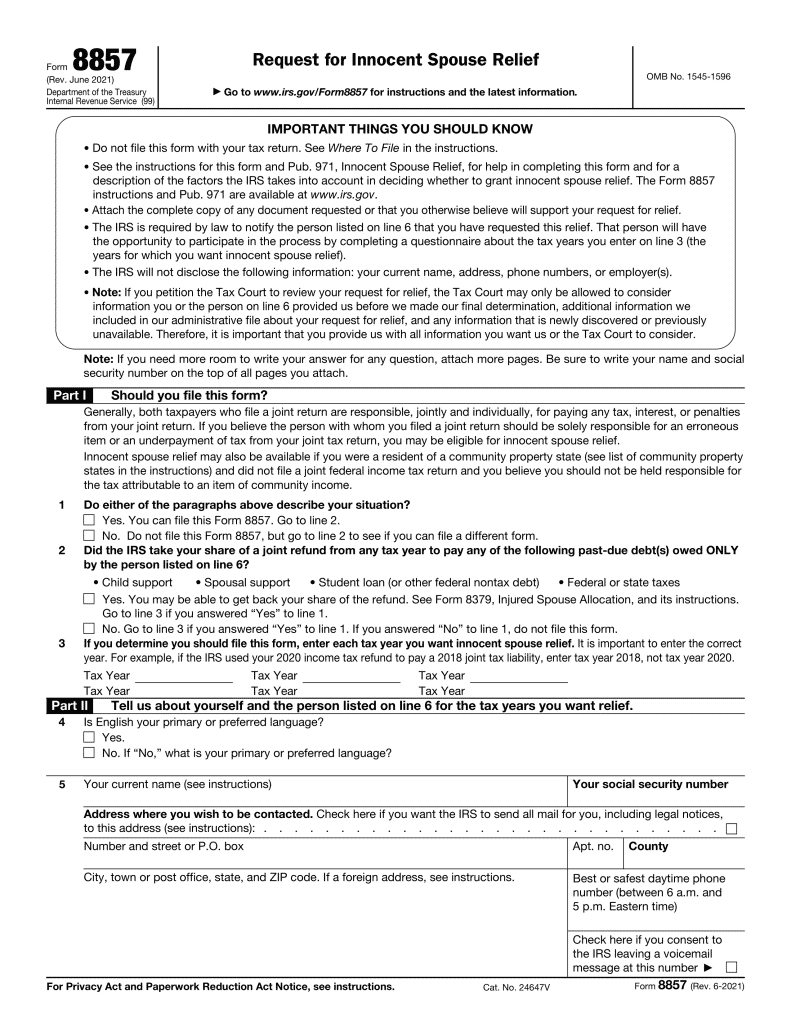

Requesting Innocent Spouse Relief: Form 8857 Instructions

When requesting innocent spouse relief, it’s important to do it right the first time. The request should be filed as soon as you know your spouse caused a tax deficiency. To request relief, you must file Form 8857.

This form asks for information regarding your spouse (or former spouse), how involved you were with the finances, and if you were ever a victim of domestic abuse to determine whether you qualify for the program.

You will also be required to provide your education history and professional experience to help the IRS determine whether you pass the “reason to know” test.

Form 8857 must be filed no later than 2 years after the IRS has attempted to collect from you.

The following IRS collection activities can kick off the 2-year period:

- The IRS takes your expected tax refund to cover a joint tax liability

- The IRS has filed a claim against you in court (i.e., bankruptcy proceeding)

- The IRS is filing a suit against you to collect the joint tax liability

- You receive an IRS Notice of Intent to Levy

We also recommend having your Form 8857 reviewed by an attorney to ensure all the submitted information is accurate and you have included enough evidence. Give us a call today and get started with a confidential consultation!

How to File Innocent Spouse Relief

Once you’ve completed the information on Form 8857, it’s time to send it off for review. This form should not be filed with your tax return.

Form 8857 must be mailed to one of the following addresses:

If using U.S. Postal Service:

Internal Revenue Service

P.O. Box 120053

Covington, KY 41012

If using FedEx or UPS:

Internal Revenue Service

7940 Kentucky Drive, Stop 840F

Florence, KY 41042

Need Help with Innocent Spouse Relief?

Tax debt is already stressful enough but being in debt for something you didn’t do is even worse. We know this can be a lot to deal with, but we can help you get through this dark time!

If you were recently notified that you owe a balance from a joint return with your spouse or former spouse, give our award-winning tax debt attorneys a call!

We’ve dealt with these situations many times and can help you increase your chances of having the debt forgiven.